In the early years of Laneway Housing development (2019 and 2020), lenders did not allow property appraisals to include what were then called “outbuildings”. Other factors made it difficult to add a laneway home or refinance a property that had one.

Those who added a laneway home to their property either had the equity to accommodate the increased borrowing requirements or endured an ad hoc financing process with the help of a good mortgage broker.

Lenders have rewritten the rules for laneway homes

Fast-forward to the spring of 2022 and institutional are lenders making laneway housing requirements and financing clearer. Those measures include:

- Square footage minimums

- Bathroom and kitchen requirements

- Laneway entrances

- “Self-contained” requirements

- Changes to appraisal requirements

Most laneway homes already meet these standards.

With lenders catching up and competing for business, we are financing laneway homes more often, with another successful Laneway Housing mortgage completed last week. In a city starved for housing inventory, laneway homes add value while opening doors to homeownership.

Please let us know if you have any Laneway Housing financing questions – we are an email, phone call or text away.

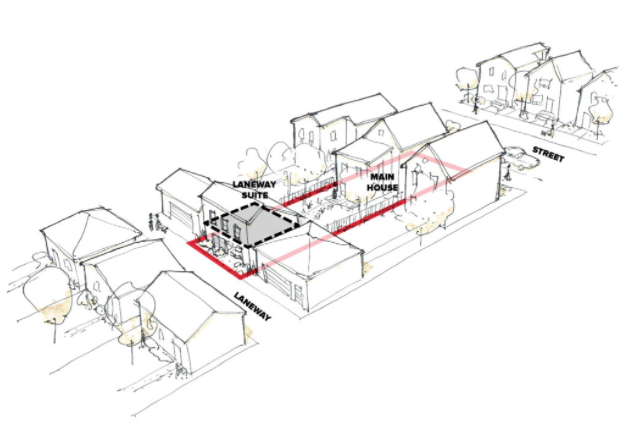

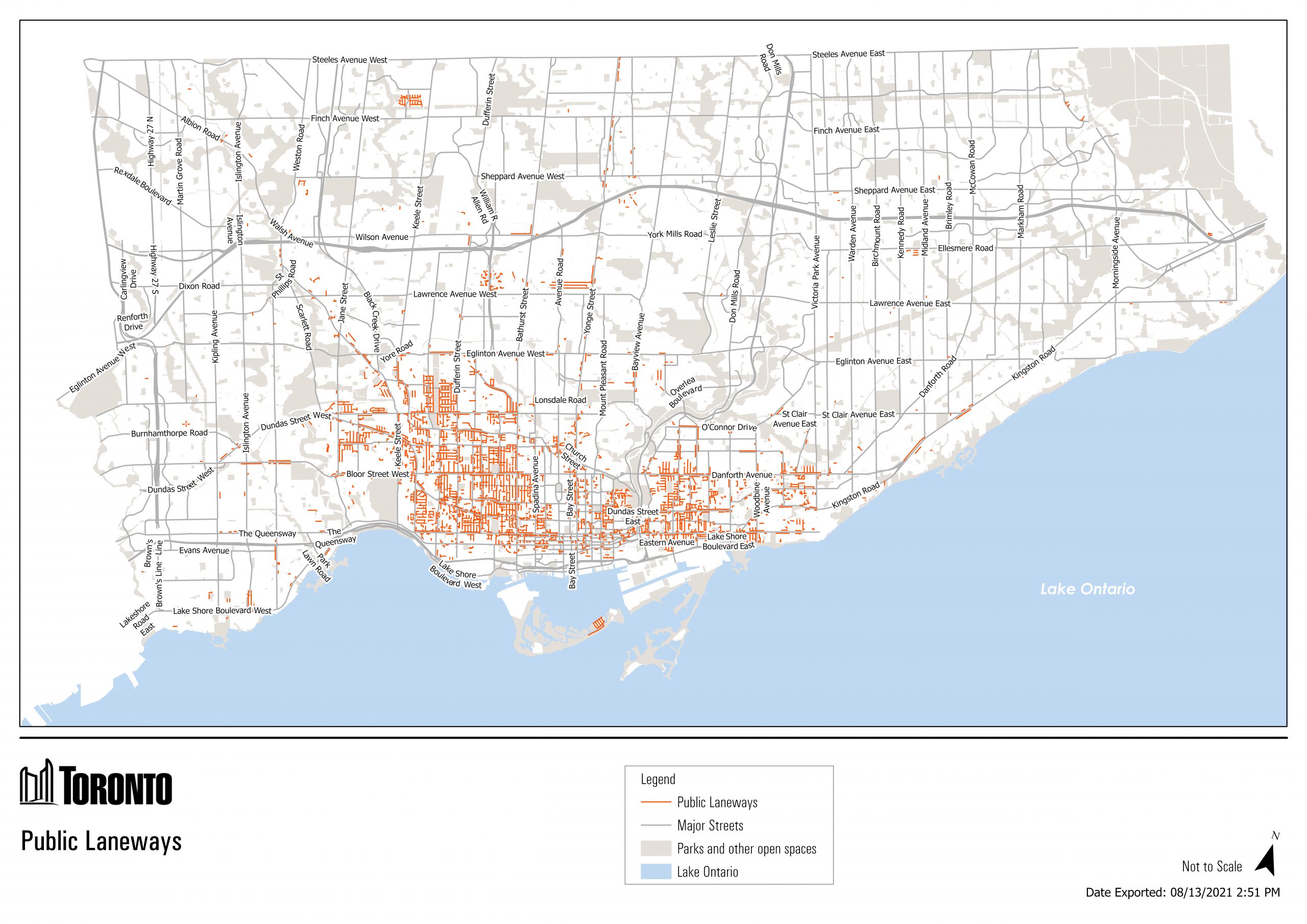

To learn more about Laneway Homes and the rules around building them in Toronto, please visit the City of Toronto’s Laneway planning and development website.

[…] Laneway houses, Garden Suites have caught the attention of homeowners now that the City of Toronto has clarified […]