On paper, the June 1st increase to the stress test was modest. A baby bump of 0.46. While most Canadians don’t understand the stress test, they do get the gist of it. Buying a home just got harder.

So did the stress test bump slow the market down? Or is inflation starting to stretch budgets? Is there some post-Covid uncertainty?

Or is it just a typical Toronto summer?

The GTA’s Summer Slumber

Toronto real estate is a frenzy of activity in the Spring. Autumn sees a nesting rush in September and October. The summer months are a chance to escape real estate and instead navigate the eight lanes of stress test we call Highways 400 and 401.

Any seasonally-adjusted change in this period would need to be drastic to indicate that the stress test is affecting borrowers. Data through June suggests that we are status quo.

Stress test math

A 0.46% increase makes mortgages roughly 5% harder to qualify for. We can help most buyers overcome that barrier as long as they aren’t buying at the very top of their budget. And that’s really the point of the stress test – to stop people from overspending.

Could inflation “inflate” caution?

Canada’s year-over-year inflation rate hit 3.6 in June. The most in a decade. Four-dollar lettuce definitely hits our pocketbooks, and the spectre of high prices and thin budgets can give buyers pause for big-ticket purchases like homes.

This is partly why the Federal Government made noise about bumping up the Stress Test — but only increased it by half a point. They understand that public perception and the caution that follows is as effective as slamming the brakes on the market.

What’s on the horizon

Persistent inflation will stoke fears of an interest rate increase from the Bank of Canada. The BoC uses rate increases to tamp down on inflation and/or an overheated economy. Countering this is the dovish stance from the US Federal Reserve, who have indicated that they will not look to raise rates in the near future. While we aren’t always in lockstep, the Fed’s position on rates generally acts as an anchor for our own.

Demand for housing could come in the form of looser Covid restrictions (especially internationally). The return of net-immigration to the GTA could spur sales — or merely stabilize them — if demand dips.

In Covid-clusion

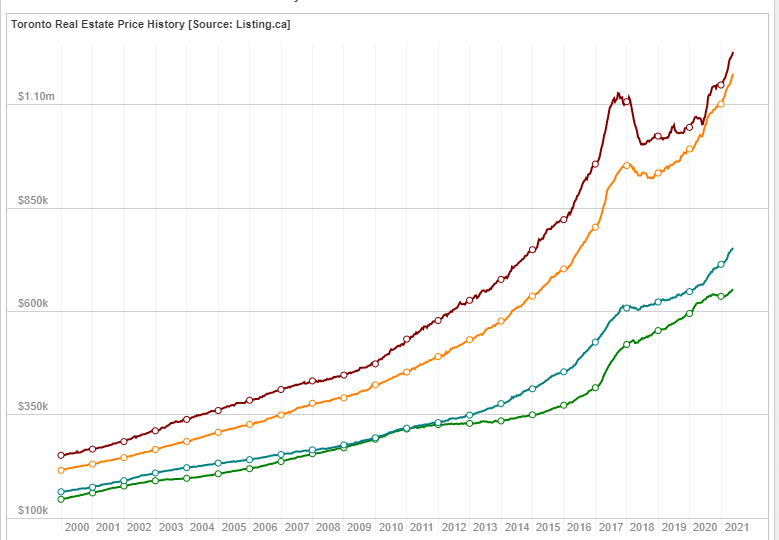

As of this writing, it’s too early to tell if changes to the stress test have impacted demand. It doesn’t look that way. Prices went parabolic in the Spring and we can expect a period of adjustment as we return to whatever normal looks like, post-Covid. We’ll have a clearer picture as we approach Labour Day. Fall buyers and market activity will return, inflation will have more data points and our local and national economies will take shape.

Enjoy your summer. I look forward to reconnecting after some much-deserved rest and relaxation.